In recent years, the government of Pakistan has taken significant steps to improve the economic well-being of the youth. One such initiative is the Maryam Nawaz Loan Scheme, which aims to empower young people by providing them with financial resources to start businesses, create jobs, and reduce unemployment. This scheme, led by Maryam Nawaz, focuses on promoting self-reliance and economic growth across the country.

Objectives of the Maryam Nawaz Loan Scheme

The Maryam Nawaz Loan Scheme is a pivotal effort in the journey toward economic empowerment. The primary objectives of this scheme are:

- Youth Empowerment: Encourage young individuals to start their businesses and become financially independent.

- Job Creation: By supporting entrepreneurship, the scheme aims to generate job opportunities.

- Economic Stability: Promotes economic growth by supporting small and medium-sized enterprises (SMEs).

- Financial Inclusion: Offers financial access to those who lack resources for business startups.

Key Features of the Loan Scheme

The Maryam Nawaz Loan Scheme is designed to be accessible to a broad audience with minimal prerequisites. Below are some of its notable features:

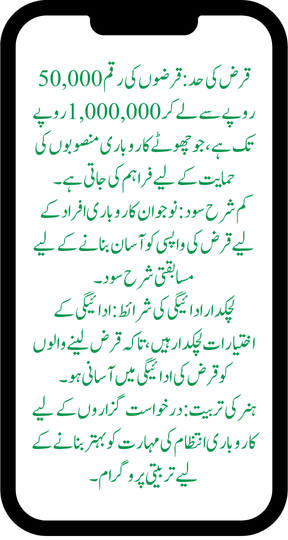

- Loan Range: Loans ranging from PKR 50,000 to PKR 1,000,000 to support small business ventures.

- Low Interest Rate: Competitive interest rates to make loan repayment manageable for young entrepreneurs.

- Flexible Repayment Terms: Repayment options are flexible, ensuring ease for borrowers in meeting loan obligations.

- Skill Development: Training programs for applicants to enhance business management skills.

Also Read: Hajj Fee Installment Scheme: Making Pilgrimage Affordable for Pakistani Pilgrims (2025)

Eligibility Criteria for the Loan Scheme

To ensure that the scheme reaches deserving candidates, specific eligibility criteria have been set:

- Age Requirement: Applicants should be between 21 and 45 years old.

- Education and Skills: Although there’s no mandatory educational requirement, those with some business skills or relevant education may have an advantage.

- Business Plan Submission: Applicants must submit a business plan highlighting the viability of their proposed venture.

- Pakistani Citizenship: Only Pakistani nationals are eligible to apply for this scheme.

Application Process for Maryam Nawaz Loan Scheme

Eligible applicants can apply for the Maryam Nawaz Loan Scheme through a streamlined process that includes online and offline channels.

Step-by-Step Guide:

- Registration: Applicants need to register through the official website or a designated bank’s branch.

- Document Submission: Submit essential documents like CNIC, business plan, educational certificates, and income statements.

- Interview and Review: Qualified applicants will be shortlisted for an interview to assess their business ideas and commitment.

- Loan Disbursement: Successful candidates will receive loan funds directly into their bank accounts.

Table: Overview of the Maryam Nawaz Loan Scheme

| Feature | Details |

|---|---|

| Loan Range | PKR 50,000 to PKR 1,000,000 |

| Interest Rate | Low and competitive |

| Repayment Period | Flexible repayment options |

| Eligibility Age | 21 to 45 years |

| Application Mode | Online and at designated bank branches |

| Documents Required | CNIC, business plan, income statement, education |

| Skill Development | Training provided for business skills |

Benefits of the Loan Scheme for the Youth

The Maryam Nawaz Loan Scheme offers numerous advantages to young Pakistanis:

- Financial Assistance: The scheme provides accessible capital to initiate new business ventures.

- Low Interest: Reduced interest rates lower the financial burden on young entrepreneurs.

- Skill Development Opportunities: Training modules improve managerial and entrepreneurial skills.

- Economic Growth: By promoting SMEs, the scheme plays a role in strengthening Pakistan’s economy.

Conclusion

The Maryam Nawaz Loan Scheme is a commendable initiative aimed at building an economically robust and independent youth in Pakistan. By offering financial support, flexible terms, and skill development, it empowers young individuals to realize their entrepreneurial dreams and contribute to the national economy. This loan scheme serves as a promising platform for ambitious youth, setting them on the path to success and self-sufficiency.